|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding the Best Pet Insurance: A Complete Beginner’s GuideAs pet ownership becomes increasingly popular, many pet parents find themselves exploring various options to ensure their furry companions lead healthy, happy lives. One such option is pet insurance, which can be an invaluable tool in managing unexpected veterinary expenses. But with a myriad of choices available, how does one determine what constitutes the best pet insurance? This guide aims to demystify the process, offering insights into what makes a policy worthwhile, and how to choose one that aligns with your needs. Firstly, it's essential to understand the primary benefits of having pet insurance. At its core, pet insurance provides a safety net that covers a portion of veterinary costs, which can be particularly reassuring during emergencies or when dealing with chronic health issues. Veterinary care, especially for unforeseen ailments, can be prohibitively expensive, and insurance can alleviate the financial burden significantly. With that in mind, what should a pet owner look for in a policy?

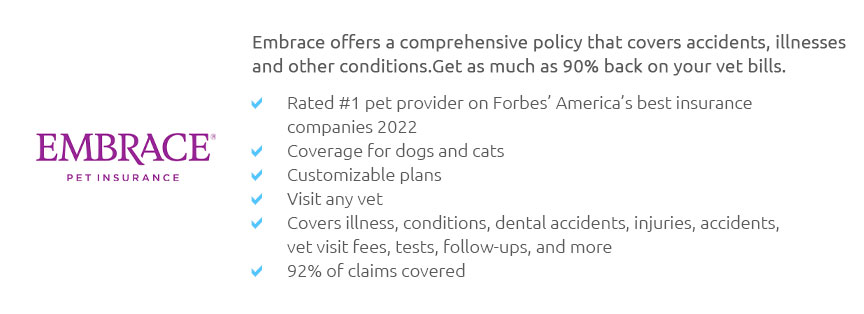

When considering the best pet insurance for your beloved companion, it’s also worthwhile to explore user reviews and ratings. These often provide real-world insights into the efficiency of claim processes, the transparency of the insurer, and the overall satisfaction of other pet owners. Providers like Trupanion, Healthy Paws, and Nationwide frequently appear in discussions as top contenders, each with their unique strengths and weaknesses. For instance, Trupanion is often praised for its straightforward claims process and no payout limits, while Healthy Paws is lauded for its quick reimbursement times and comprehensive coverage. Nationwide, on the other hand, is appreciated for its range of coverage options, including exotic pets. Ultimately, the best pet insurance is one that aligns seamlessly with your financial capabilities and your pet’s health requirements. It is prudent to compare several quotes, understand the specifics of each policy, and, if possible, consult with your veterinarian for recommendations based on your pet’s medical history and potential future needs. Remember, while cost is a significant factor, the peace of mind that comes with knowing you can provide the best care for your pet is priceless. In conclusion, pet insurance is not a one-size-fits-all solution, and what works for one pet owner may not necessarily be the best for another. By carefully assessing your options and considering your pet’s unique needs, you can make an informed decision that ensures your furry friend receives the best possible care without the financial strain. This guide aims to empower you with the knowledge to make that decision confidently, ensuring a happier, healthier life for your cherished companion. https://www.consumerreports.org/money/pet-insurance/is-pet-insurance-worth-it-a8622180631/

At Consumer Reports, we rated eight pet insurance providers: ASPCA, Banfield, Embrace, Fetch, Healthy Paws, Nationwide Pet Insurance, Pets Best, ... https://www.reddit.com/r/petinsurancereviews/comments/1c0bno9/best_pet_insurance_for_dogs_cats_according_to/

After looking through and comparing the options, Lemonade pet insurance stood out as the best one. The price seemed reasonable, their website ... https://www.cnbc.com/select/best-cheap-pet-insurance/

Best cheap pet insurance - Best for multiple pets: Spot - Best for senior pets: Pets Best - Best for Costco members: Figo - Best for speedy claims: ...

|